National FAFSA Week of Action

The White House and the US Department of Education (ED) are announcing a Free Application for Federal Student Aid (FAFSA) Week of Action, which will take place April 15-19. The announcement comes as advocates across the country are calling with increasing urgency for a concerted effort from all stakeholders and at all levels to assist students and families with completing the 2024-25 award year FAFSA. Check out these FAFSA resources below:

Financial Aid

It’s time to make your college dream a reality! Use the information below to get the money you need to pay for your college education. And pay attention to deadlines… missing one could cost you to lose out on big bucks!

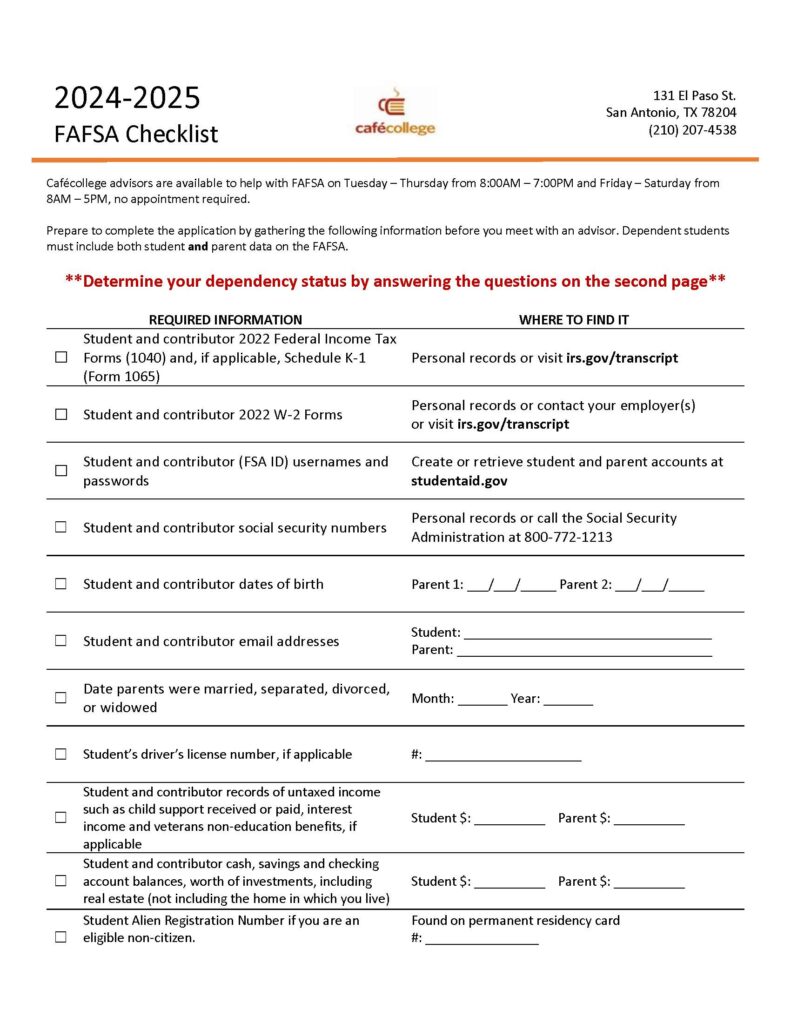

The FAFSA TO DO List: Before You Start Collect

The FAFSA To Do List: Before You Start, continued…

1- Income tax returns of parent/guardian if a DEPENDENT student, using income records for the year prior to the academic year for which you are applying.

2- W-2 forms and other records of income; If you work and you file a tax return, you must include this information in the FAFSA.

3- Your Social Security number

4- Your spouse’s Social Security number

5- Your Alien Registration Number if you are not a U.S. citizen.

6- If you are married, know your date of marriage; date of birth

7- Information on savings, investments, and business assets for yourself and for your spouse of you are married

8- If you are married, you need to collect federal tax information or tax returns, including W-2 information, for yourself and for your spouse.

9- Complete the FAFSA (Free Application for Federal Student Aid) after October 1st online. Come by cafécollege for assistance!

Learn The Financial Aid Language

Loans:

Stafford – loans awarded in two forms (1) subsidized and (2) unsubsidized

Subsidized – DO NOT accrue interest while you are in school and during repayment

Unsubsidized loan – accrues interest while you are in school and during repayment

Grants:

Pell Grant – Federal grant by the Department of Education

SEOG – Supplemental Educational Opportunity Grant

Scholarships:

Institutional – school awarded scholarships based on academics, athletics, extracurricular, leadership, etc.

Miscellaneous – scholarships sponsored by corporate companies, organizations, businesses, student’s high school

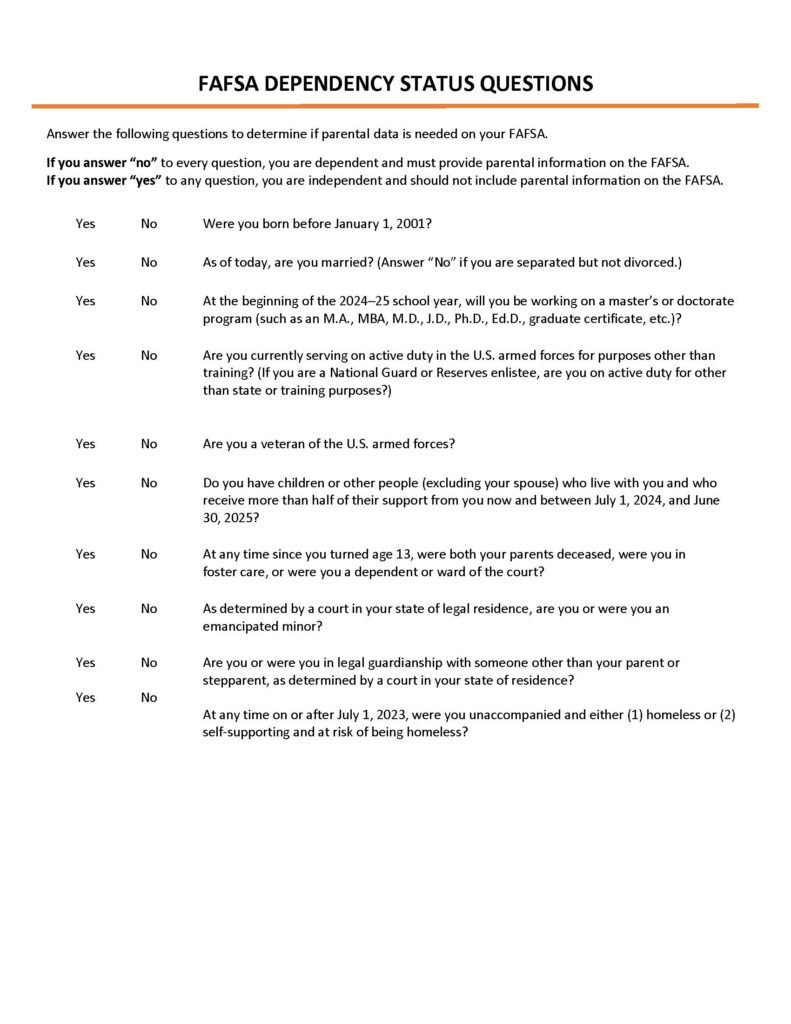

Free Application for Federal Student Aid (FAFSA)

Filling out the FAFSA (Free Application for Federal Student Aid) is so important!

Distributed and processed by the U.S. Department of Education, the FAFSA collects the information required to determine need and eligibility for financial aid. It is needed in order to apply for virtually all Federal Title IV student aid programs, including Pell Grants, Stafford Loans and the campus-based programs. The FAFSA opens on October 1st of every year and must be completed for every year a student intends to enroll in a post-secondary program.

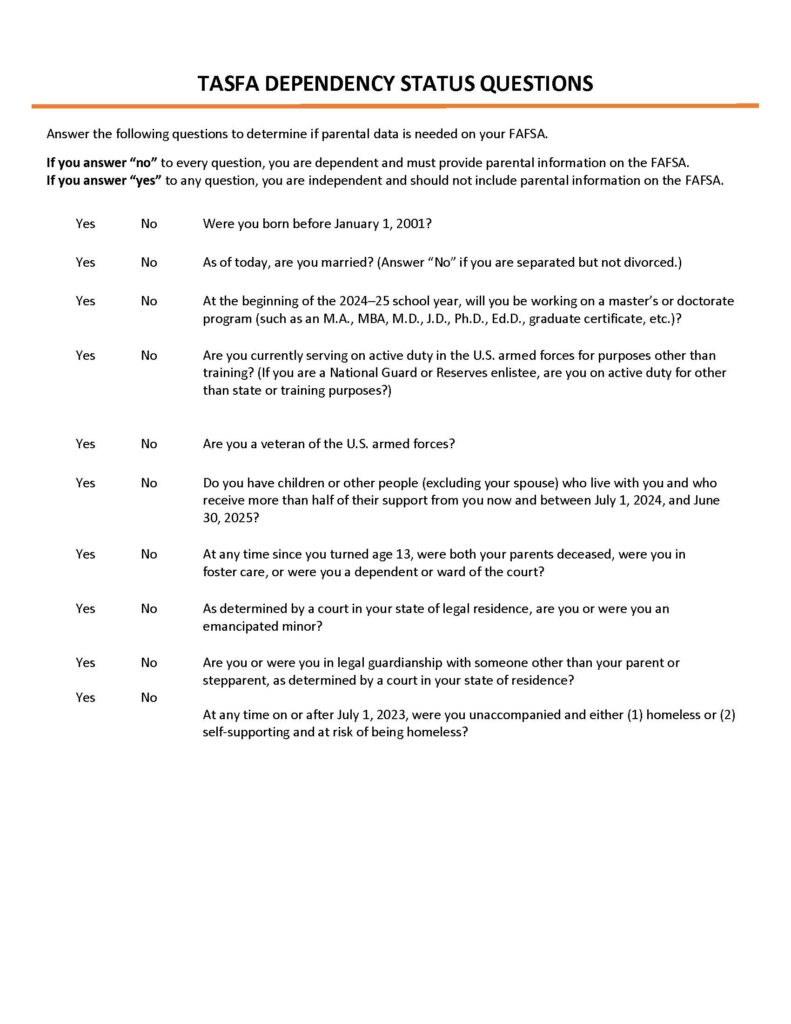

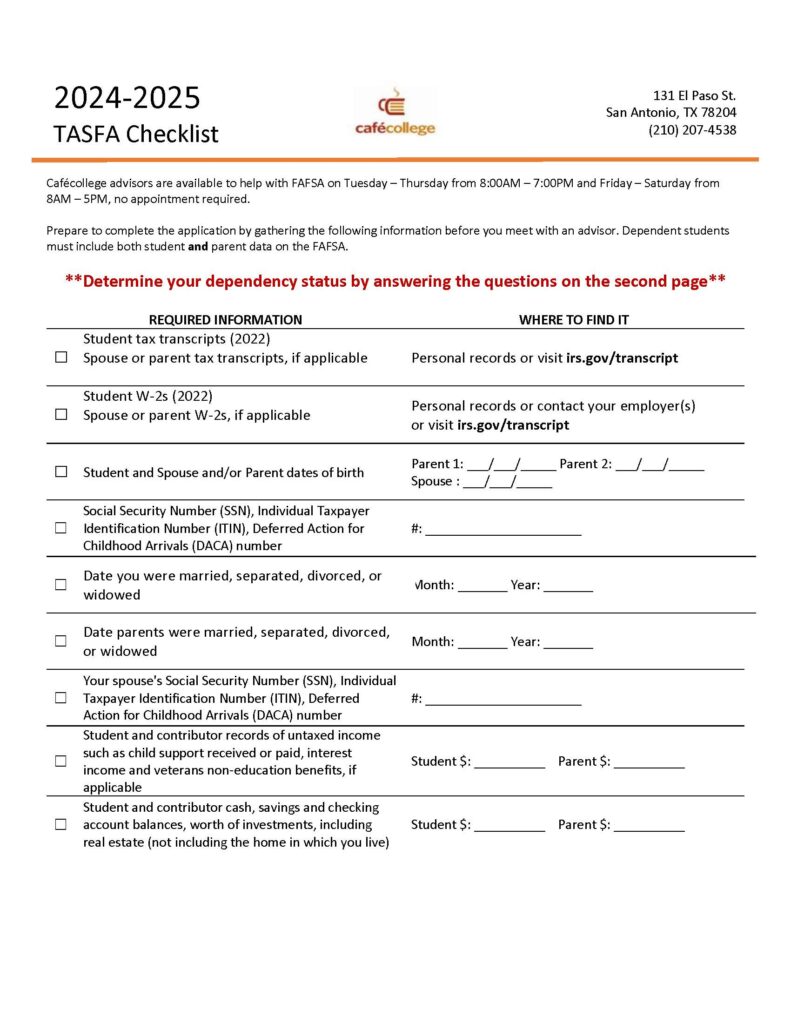

Texas Application for State Financial Aid (TASFA)

Work Study

On campus or off campus work to help earn money for student’s education. You can apply for work study through the FASFA application.

FAFSA Scams

1 – Organizations that say they can help you locate more aid and then charge you a fee

2 – Anyone who charges you a fee for information about financial aid

3 – If they charge you a fee to complete the Free Application for Federal Student Aid (FAFSA)

4 – If they charge a fee to receive financial aid